Table of Content

You simply type in the address and it will indicate if the location is eligible or not.

If you intend to purchase a house that requires a lot of renovation, a strict appraiser might not readily approve your home. To obtain a USDA loan, you must fall under the required income limit for moderate income. These limits are based on both the local market conditions and the size of a family. Household income is calculated by adding the loan applicant’s income plus the income of other family members in a home. This rule applies even if the household member does not share the same family name.

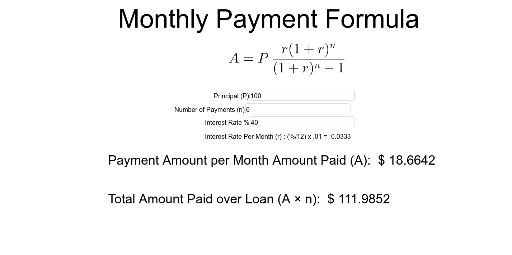

Tips on calculating your USDA loan monthly payment

We’ll find you a highly rated lender in just a few minutes. Finally, select how long your repayment term will be — 15 or 30 years. Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. Here is a list of our partners and here's how we make money. Speak with a loan officer to learn more about income eligibility.

There are a few suburban areas that meet the USDA criteria. USDA loans require that you pay your property taxes every year through your lender. The lender will divide your annual property tax amount by 12 and add the amount to your monthly house payment. Payment assistance is a type of subsidy that reduces the mortgage payment for a short time. The amount of assistance is determined by the adjusted family income.

Down Payment

So, if you want to buy a fixer-upper, you can bring it back to life with the help of a USDA loan with up to 10k in repairs. The only other type of mortgage that allows this the VA loan. However, in order to obtain a VA loan, you must have been a member of the military. USDA-approved lenders and see who gives you the best deal.

In addition to the guarantee fees, you’ll also need to consider other costs. In most cases, your mortgage lender will include these in your monthly payment. Your lender will then set aside the extra funds you pay each month to pay the other costs for you, usually once a year. Even more importantly, we add the mortgage insurance premium — the USDA calls it a guarantee fee — into the payment calculation.

How the USDA Annual Fee is Calculated

When you make a payment, the interest that has accumulated since your last payment is paid first, bringing your accrued interest balance to zero. As with any other mortgage, you will be required to obtain an appraisal for your new home. The difference is that the appraiser must also state that the condition of the home meets USDA standards. The home you plan to obtain aUSDA mortgagefor must be in eligible locations around the US. Most homes are rural; however, some suburban areas may qualify. A USDA loan is meant to help low- and very-low-income borrowers get a foot on the property ladder, especially those who have no other way to afford to buy a home.

Within this broad definition, an estimated 100 million people over 97% of the nation’s land may be eligible. Have you always dreamed of living in the country but thought it was too much to afford? Or maybe you’d like to live in the outer lying areas of the suburbs, but you can’t quite qualify for a standard mortgage. No, the USDA Rural Housing Program can be used by first-time buyers and repeat buyers alike. In short, USDA home loans are putting people in homes who never thought they could do anything but rent.

The program means to helplow-incomeindividuals and families live a better quality of life in a home of their own. By enabling homeownership, the USDA helps create stable communities for households of all sizes. You also need to shop around with a few different USDA mortgage lenders.

The USDA upfront guarantee fee is calculated as 1% of your total loan amount. Our mortgage calculator assumes you are rolling this fee into your final loan amount, but you have the option to pay the fee upfront at closing. Paying the USDA guarantee fee upfront will save money since rolling the fee into your loan increases the amount you're borrowing to purchase your home. The property taxes and homeowners insurance premiums shown here are estimates. They could be higher, and these costs will likely rise over time after you buy your home. Similarly to property taxes, your lender will pay your homeowners insurance each year.

But in fact, 97% of the U.S. map is eligible for USDA loans, including many suburban areas near major cities. Any area with a population of 20,000 or less can be an eligible rural area. Welcome to the Rural Development, Rural Housing Service, Home Loans Web site. Homeowners who buy or refinance at today's low rates may benefit from recent rate volatility. In 2015, the USDA announced updated guidelines for what they consider as rural areas.

Yes, the USDA loan program can be used to permanently install equipment to assist household members with physical disabilities. Yes, self-employed people can use the USDA Rural Housing Program. The USDA Rural Housing loan is available as a 30-year fixed-rate mortgage only.

The owner of this website may be compensated in exchange for featured placement of certain sponsored products and services, or your clicking on links posted on this website. This compensation may impact how and where products appear on this site . SuperMoney strives to provide a wide array of offers for our users, but our offers do not represent all financial services companies or products.

No comments:

Post a Comment