Table of Content

Only recently has it been updated and adjusted to appeal to rural and suburban buyers nationwide. The only exception is for very-low-income borrowers, who may qualify for a USDA Direct home loan. In this case, you’d go straight to the Department of Agriculture to apply rather than to a private lender. To be eligible, you can’t make more than 115% of the area median income.

All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly. Late mortgage payments will incur penalty fees that will be due in addition to your regular monthly payment. Even though USDA mortgages usually require no down payment, you can lower the monthly bite it takes out of your budget by reducing the size of your loan.

Property Type

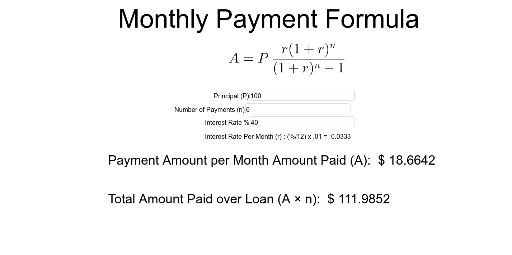

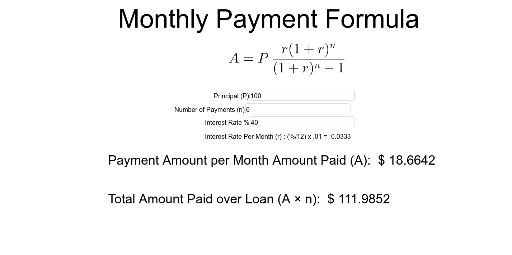

Mortgage interest is the cost you pay your lender each year to borrow their money and is expressed as a percentage. The USDA payment calculator will automatically enter the current average interest rate. Remember, your monthly repayment residence fee consists of extra more than just simply repaying the quantity you borrowed to buy the house. The “essential” is the quantity you borrowed and ought to pay back , and the interest is the quantity of the lender costs for lending you the cash.

Avoiding the down payment, getting an equivalent interest rate, and cheaper monthly mortgage insurance…for me, USDA was a no-brainer. While you won’t have a down payment, you will still need to have money available to pay for closing costs. However; USDA allows the seller to contribute up to 6% towards closing costs. Rates are competitive as long as you have qualifying credit and income. USDA loan rates are often lower than conventional 30-year fixed mortgage rates.

How do I obtain a USDA loan?

If you’re struggling with reduced income but have a good credit history, consider taking a USDA guaranteed loan. Having a good credit history makes you an ideal candidate. You may still qualify for a USDA loan even if a low income makes you ineligible for a conventional mortgage.

Most home loans require at the least 3% of the rate of the house as a down payments fee. Some loans, like VA loans and a few USDA loans permit 0 down. Although it is a delusion that a 20% down fee is needed to acquire a mortgage, preserve in thoughts that the better your down payments fee, the decrease your monthly fee. A 20% down fee additionally permits you to keep away from paying personal loan coverage for your mortgage. I was prequalified for an FHA mortgage and shopping for my home when I heard about the USDA mortgage. I didn’t know much about it, but called to see what the deal was.

USDA Loans Pro and Cons

But with 3% down, it’s reduced to $2,425, while a 5% down lowers the upfront guarantee fee to $2,375. You say you don’t have a great credit score and can’t make a down payment? With a USDA home loan, you can still get a loan with favorable terms. There are only certain geographical areas that qualify as eligible rural areas. The benefit of government backing means that you, the homeowner, will pay lower interest rates and no down payment. You will, however, have to pay USDA loan closing costs, which can be anywhere between 2% and 5% of the purchase price.

Your homeowners insurance premium might end up being more than you expect, or maybe you’ll get a slightly different interest rate than the one you’re inputting. They offer up to 100% financing, low interest rates and fees, and thus, low monthly payments. This makes them a great incentive to move to an eligible area. They work for first-time home buyers and veteran home buyers alike. To qualify for a USDA loan, your total debt-to-income ratio should be no more than 41%. Additionally, your monthly housing-related expenses (mortgage payments, taxes, etc.) can not exceed 29% of your income.

Overall, it significantly reduces your total interest charges over the life of the loan. Even with a zero-down option, it makes better sense to save a small down payment for a USDA loan. Thus, it’s best to save a little down payment before you take this mortgage option. Using our calculator on top, let’s estimate mortgage payments with the following example. Let’s say you took a 30-year fixed USDA loan worth $250,000 at 3% APR. The following table compares the cost of making no down payment, a 3% down, and a 5% down on your loan.

With no down payment, your total interest will amount to $129,444. But if you pay 3% down, your interest charges will decrease to $125,560, while a 5% down will reduce your total interest costs to $122,971. A 3% down will save you $3,884 on total interest charges, while a 5% down will save you $6,473. The higher your down payment, the more you’ll save on interest costs. SuperMoney.com is an independent, advertising-supported service.

There is no 15-year fixed option, or adjustable-rate mortgage program available via the USDA. USDA lenders have to send each loan file to the Department of Agriculture to be approved before underwriting. This can add around two to three weeks to your loan processing time.

The U.S. Department of Agriculture supports homeownership opportunities for low- and moderate-income Americans through several loan, grant and loan guarantee programs. For qualified borrowers, USDA loans are provided directly through USDA Rural Development or from an approved lender. Because closing costs vary, be sure to shop around to find the most suitable combination of low mortgage rates and low costs. The USDA sets no loan limits, but the amount you can borrow is limited by your income and your household’s debt-to-income ratio.

Our mortgage calculator shows a breakdown of your USDA loan total including purchase price, down payment and the USDA Guarantee Fee. On the other hand, because it’s strictly limited to USDA rural areas, finding the right location may be challenging. It may not be an option especially if you have a stable job in the city. USDA loans also cannot be used for vacation homes or investment property that generates income.

No comments:

Post a Comment